Insurance

“How can explosion touch me?”

The sentence used in the title of this post belongs with Alex's "Strictly feminine is the woman devoid of superfluous hair" in terms of arcane impenetrability the more you repeat it.Is separate explosion insurance for homeowners still a thing?

Ad source.

Posted By: Paul - Sun Nov 07, 2021 -

Comments (4)

Category: Destruction, Domestic, Codes, Cryptography, Puzzles, Riddles, Rebuses and Other Language Alterations, Insurance, 1930s

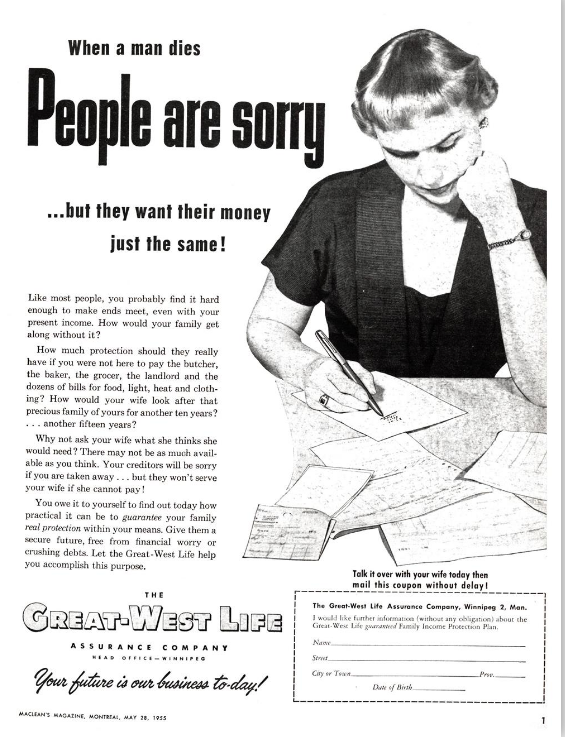

Follies of the Madmen #457

Man, that's a hard-nosed ad! No mincing words. Could it run today?

Source.

Posted By: Paul - Tue Dec 17, 2019 -

Comments (3)

Category: Business, Advertising, Insurance, Death, 1950s

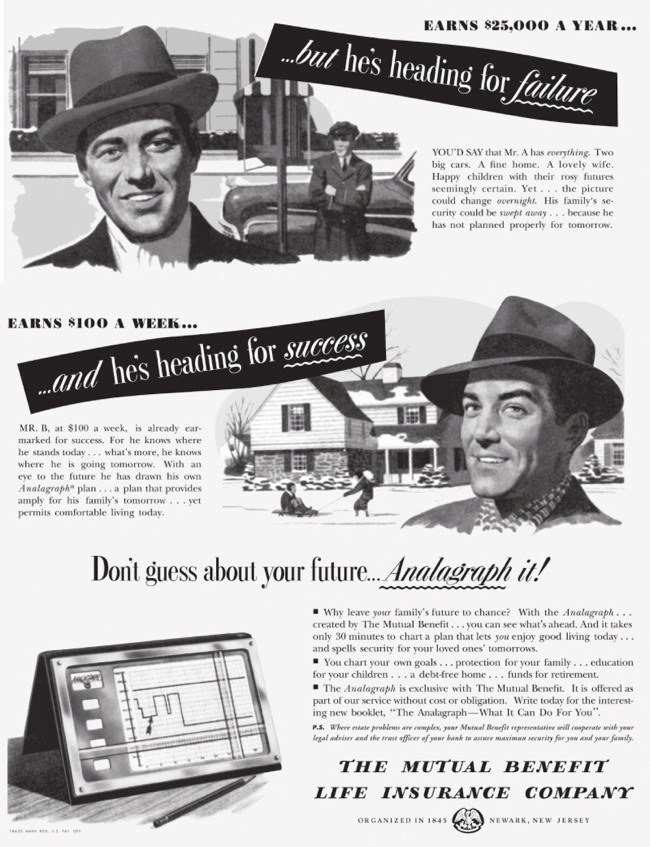

Don’t guess about your future… Analagraph it!

The Mutual Benefit Life Insurance Company marketed its electronic analagraph service from the late 1930s to the 1970s. They described it as "a scientific device that lets you chart the family and its retirement needs." They even had an "analagraph school" in Newark, New Jersey where their employees would be sent to get trained as analagraphers.

More recently, Electronic Development Labs has marketed an "analagraph recorder" for use by chiropractors. I found an explanation of what this device does in the book Pendulum Power:

Posted By: Alex - Wed Oct 12, 2016 -

Comments (5)

Category: Business, Insurance

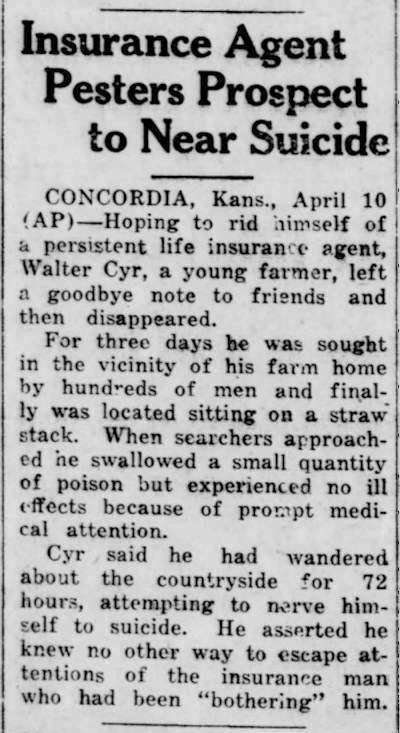

Tries suicide to escape persistent life insurance salesman

The present-day equivalent of this, I think, would be the feelings of desperation and rage that persistent telemarketers can cause. (Though thanks to caller ID, I just never pick up when they call, which is multiple times every day since the "do not call list" is apparently a complete farce.)

Kingsport Times - Apr 10, 1929

CONCORDIA, Kans., April 10 (AP) —Hoping to rid himself of a persistent life insurance agent, Walter Cyr, a young farmer, left a goodbye note to friends and then disappeared.

For three days he was sought in the vicinity of his farm home by hundreds of men and finally was located sitting on a straw stack. When searchers approached he swallowed a small quantity of poison but experienced no ill effects because of prompt medical attention.

Cyr said he had wandered about the countryside for 72 hours, attempting to nerve himself to suicide. He asserted he knew no other way to escape attentions of the insurance man who had been "bothering" him.

Posted By: Alex - Tue Jan 12, 2016 -

Comments (12)

Category: Annoying Things, Insurance, Suicide, 1920s

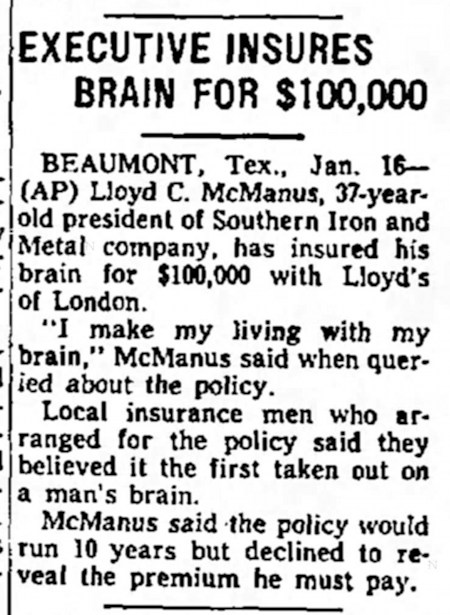

Insured his brain

1957: Lloyd McManus, president of the Southern Iron and Metal company, insured his brain for $100,000, noting that, "I make my living with my brain."The inevitable jokes followed in the media: A penny for his thoughts, what happens if he has a brainstorm, etc...

The Bridgeport Telegram — Jan 17, 1957

Posted By: Alex - Wed Dec 30, 2015 -

Comments (7)

Category: Insurance, 1950s, Brain

Nessie-sary Insurance

A Scottish cruise line felt the need to take out an unusual insurance policy. They are covered in the event that the Loch Ness Monster should damage one of their ships. That is sure to make their passengers feel so much more secure.

Posted By: Alex - Sat May 04, 2013 -

Comments (5)

Category: Insurance

Calamity Board Game

Gosh, this looks like a really not boring, laugh-a-minute game. And perfect for these economic times!

Stick to your kitty cats, Andy!

More pix and info here.

Posted By: Paul - Wed Sep 19, 2012 -

Comments (9)

Category: Celebrities, Games, Insurance, 1980s

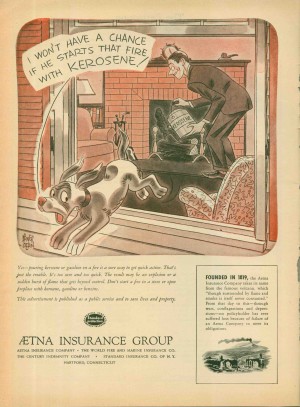

Follies of the Mad Men #14

Yes, we believe our clients are dumber than a sack of troll dolls, and are not afraid to insult them to their faces.This illustration, by the way, comes from the great Abner Dean.

Posted By: Paul - Fri Aug 22, 2008 -

Comments (11)

Category: Business, Advertising, Insurance, Death, Explosives, Pets, Dogs, Stupidity

Follies of the Mad Men #7

[From Fortune for December 1936. Two image files, click separately.]

Sniffles = Death.

Not the most subtle or believable of Madison Avenue appeals. Sure, in that pre-antibiotic age, pneumonia was deadly. But I can't imagine that the proportion of cold-sufferers who contracted pneumonia--at least among the affluent audience for Fortune--was any higher then than it is today. In other words, miniscule.

Posted By: Paul - Thu Jul 31, 2008 -

Comments (8)

Category: Business, Advertising, Insurance, Death, Family, Hygiene, Medicine, Couples

| Who We Are |

|---|

| Alex Boese Alex is the creator and curator of the Museum of Hoaxes. He's also the author of various weird, non-fiction, science-themed books such as Elephants on Acid and Psychedelic Apes. Paul Di Filippo Paul has been paid to put weird ideas into fictional form for over thirty years, in his career as a noted science fiction writer. He has recently begun blogging on many curious topics with three fellow writers at The Inferior 4+1. Contact Us |